What Is Housing Loan Repayment

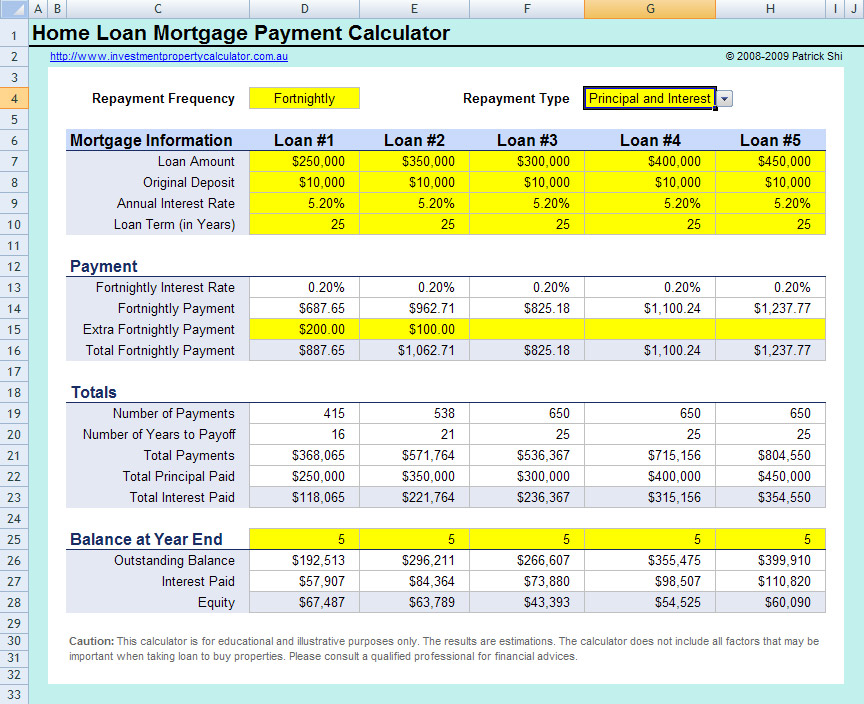

This amount may not be the final amount you need to re finance your property and is used solely for the purpose of providing you with an indication of the loan amount you may require the upfront costs you may incur and the.

What is housing loan repayment. For example for a 20 year loan of 100 000 at 3 interest the total repayment over the lifespan of the loan is about 133 000. Home loan repayment calculator faq. However housing withdrawal limits set by cpf may apply.

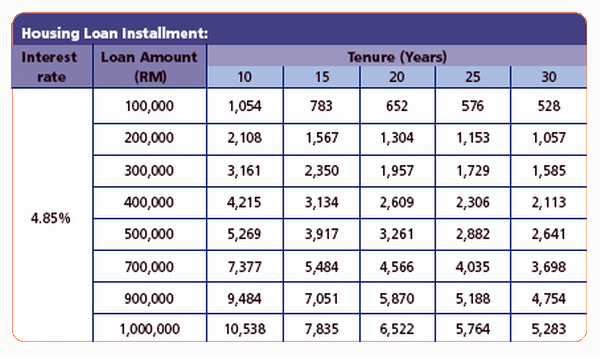

A home loan which is also sometimes known as a house loan or a housing loan is an amount of money the ultimate guide to maharera registration the real estate regulation and development act 2016 has been in force since may 20171. The maximum repayment period for a housing loan from a bank is 30 years. The loan amount has been calculated based on the information input by you and information sourced by third parties.

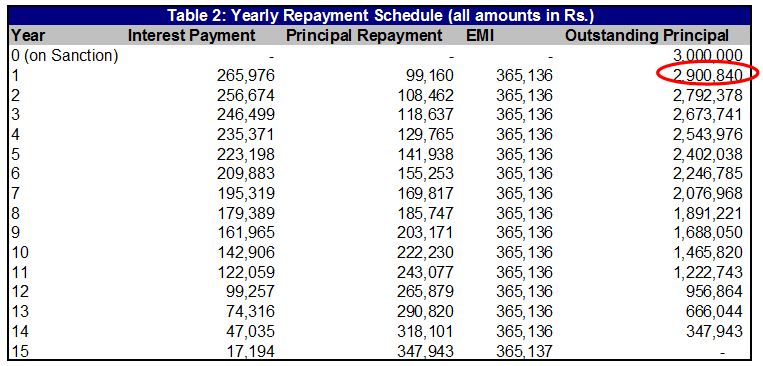

For interest only loans once the interest only period expires the loan will revert to the applicable variable rate loan for the remainder of the loan term unless another interest rate period is taken. Home loan repayment schedule also called amortisation schedule is information often given in a tabular format about each emi payment per month from the start to the end with a breakdown of the principal component and interest component of the loan. From 06 july 2018.

Reserving oa savings for housing. This is a safeguard against overspending on housing loan repayments at the expense of your retirement savings. It is indeed true that if you take more time to pay off a housing loan a higher percentage of repayment goes towards servicing the interest.

2 or more. Loan repayment is the act of paying back the borrowed money to the lender. For fixed rate loans once the fixed rate period expires the loan reverts to a variable rate loan and repayment amounts will change.

1 outstanding housing loan. What is the loan ceiling. Different loan ceilings will apply depending on the date of booking or option to purchase.

For example a housing loan of 500 000 at an interest rate of 2 5 percent over a 10 year period will work out to be a monthly repayment of 4 713 with a total interest cost of 65 560. What is loan repayment. Find out more about how you can use your cpf for housing.

What is home loan repayment schedule.